My favorite niche social network is StockTwits. Period. You should know that I’m not an investor in StockTwits, nor am I affiliated with the company in any way. I’m just one of about 600,000 people who use the network and service via its website every month. In my case, I use it every day. Well almost every day. OK – just the days that the stock market is open, which is about 250 days per year.

Before I tell you why this social network is so great, here’s some background for anyone that’s new to StockTwits. The company was co-founded in 2008 by long-time investor Howard Lindzon, who is also the head StockTwit (CEO). At its core, StockTwits is a social network for traders that lets users share stock-related information in real-time. Analysts, media, and investors post frequently to the network, and even public companies have a StockTwits identity and post. However, the power users are day and swing traders.

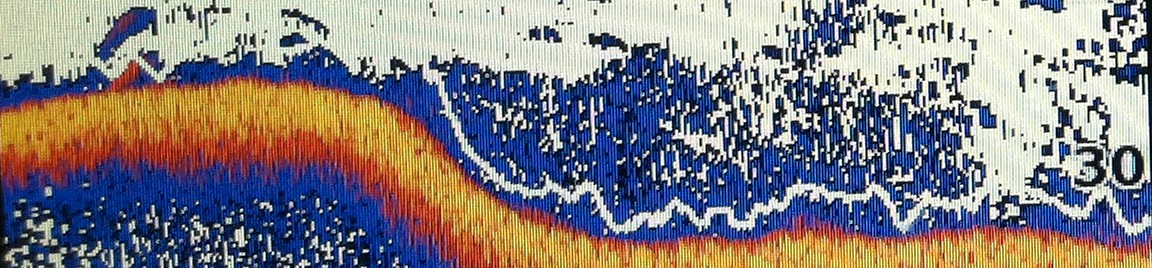

StockTwits uses a messaging infrastructure similar to Twitter that can be filtered in various ways. Each public company has its own $TICKER stream, which is referenced by prepending a $ to its stock symbol. The ticker stream (cashtag) for Apple is $AAPL, for Google its $GOOG, etc. A single message consists of ideas, references, charts, and other financial data that are condensed by the user into 140 characters by using text, short links, cashtags, hashtags, etc. In Twitter-like fashion, it’s easy for users to follow individual stocks and specific contributors (@username). Here’s a partial screenshot that shows what the ticker stream and environment looks like for $AAPL:

Notice that the change in community sentiment for each stock (rolling 7 day average) is displayed in the ticker stream header. The same goes for message volume. In this $AAPL example, community sentiment and message volume have increased slightly over the past week. Traders have the option to specify their current sentiment in each message by including a Bullish or Bearish tag (see @Fibline message above).

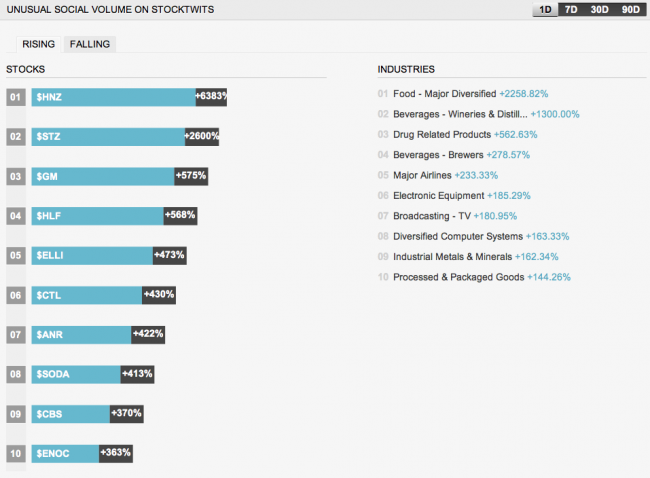

I’m a big fan of heat maps, because complex data and relationships can be understood almost instantaneously. StockTwits provides a heat map that profiles message stream traffic across industry sectors and companies based on stock price movement and community message volume. Check out this screenshot for the Technology sector:

It’s easy to see that $BBRY and $AAPL dominated discussions today. I spend most of my time in the Technology sector, and I can tell you that $AAPL has the highest message volume most days. In this case, $AAPL was number 2 even though the stock price closed where it opened. $BBRY is a volatile situation and got a nice bounce in price, so it has a green background. Hover your mouse over any ticker and the percentage change in stock price is displayed – in this case over the past 24 hours. As you can see at the top right, 12 hour, 6 hour, and 1 hour intervals are available. Click on any ticker and move directly to its message stream. So the heat map provides a complete view of what’s happening in the sector with one click access to any ticker stream that deserves your attention.

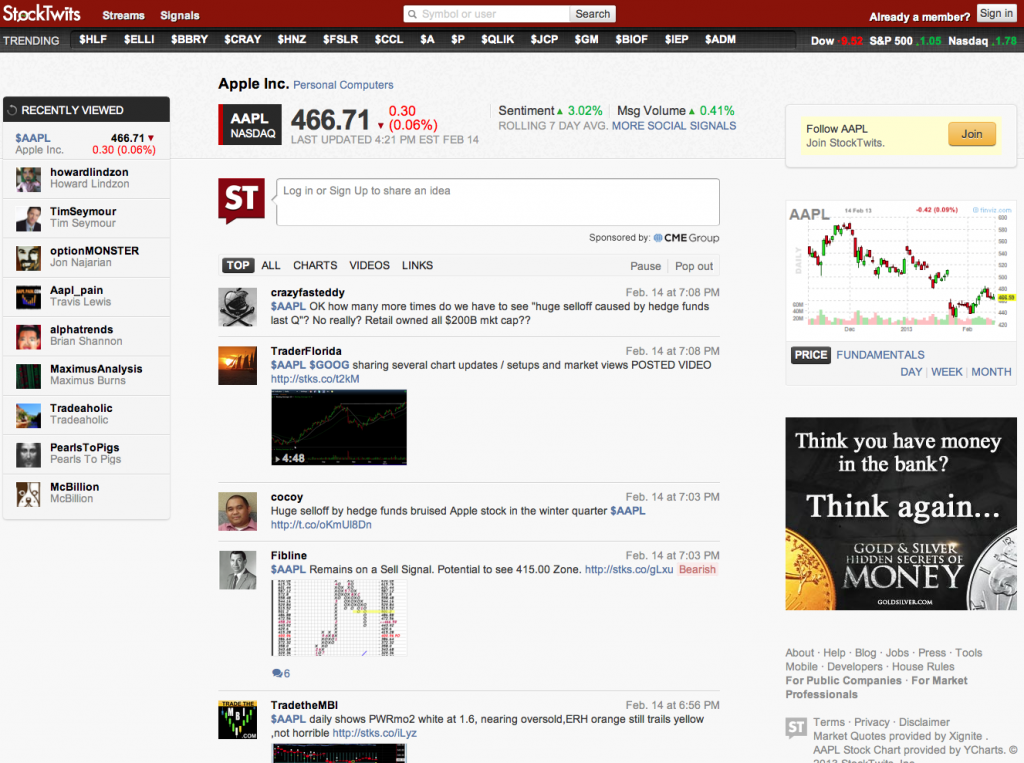

Message volume is a very interesting, and valuable social metric. In the StockTwits screenshot below, the stocks with the most unusual increases (and decreases) in social volume are charted. as well as investment categories as a whole. I’ve learned a lot watching the StockTwits community parse, analyze, and weigh in on market events and implications as they occur in real-time.

There are many other useful capabilities – too many to talk about in this post. At this point, I want to list the top 10 reasons why I like StockTwits from a long-term investor point of view:

- Daily news: StockTwits is excellent source of daily news – not just financial news, but news involving new products, technologies, delivery models, startup companies, adoption impediments, competitive dynamics, etc. News is crowdsourced by community experts and easily filtered from a ticker stream via the LINKS Button.

- Technical fundamentals: Good instincts are important, but I’m a mathematician that needs strategies and plans that are based on logic, insight, and experience. Ticker streams ground me in the fundamentals, and force tactical insight into setup patterns that may be in motion.

- Passive access to experts: For a given stock, it’s pretty easy to identify top contributors and experts in the StockTwits community. Trust is gained soon enough, because concise investment theses are routinely published and backed up with core financial data, analysis, and graphs. My diligence process leverages combinations of experts within and across tickers, because the fact is that they know more about investing than I’ll ever know.

- Filtered market noise and emotion: The StockTwits community helps me filter market noise and curtail emotion. This is a highly curated crowd of hard-core investors that live and die by the sword in day and swing trades. They trade on fundamentals and community sentiment, and back up their moves with charts, graphs, logic, and comparisons.

- Front-end diligence: I don’t have the time to do an endless amount of due diligence before I make investments. StockTwits helps me filter through top prospects on the front end and refine my thinking to focus on a smaller set of opportunities.

- Trading hygiene: Spending a few minutes each day on StockTwits improves my trading hygiene. The community chatter and banter is lined with generic advice and reminders. For example, experts regularly publish new stop values based on real-time activity, trends, and ongoing analysis. It’s a constant reminder that establishing and adjusting stop-loss trades for every investment is imperative – no exceptions!

- Risk-return profiles: The number and combined value of my direct investments have decreased since joining the StockTwits community. After careful thought, I’ve decided that this is a good thing. My ability to qualify investment opportunities has improved, and I feel like I’m better at quantifying and managing risk. Even though I have fewer active investments and dollars, I think the risk-return profiles are better. The search for attractive stocks continues, but it seems harder for me to leap in these days. Particularly when I factor in concerns about the stock market at large.

- Trade timing: Technical insight combined with sentiment analysis improves my entry and exit timing. Furthermore, the number of times I get out and take a break because of negative sentiment has risen – which has proven to be a good thing.

- New investment litmus test: Sniffing the StockTwits conversation stream and analyzing current sentiment on a particular stock is my final litmus test for pulling the trigger on a new investment. I’ve delayed, and in fact aborted, investments because of late breaking news and chatter from the community that degraded risk profiles to the point of torching my comfort level.

- Zero cost: The immense value I get from StockTwits is free!

I suppose I should temper everything I’ve said by restating that the majority of ideas and messaging in StockTwits are produced by day and swing traders. By nature these guys are focused on exploiting short-term price momentum as opposed to the strategic or deep-rooted value of a company. As such, I’ve seen posts that jokingly suggest that long-term investors might not want to spend too much time in the StockTwits ticker streams because it wears on the nerves. But the reality is that they do – they’re just not visible.

As you can see, I’m a long-term investor who likes to pay attention when the market is open. To some extent, I see StockTwits as MBWA – management by walking around. Every so often it’s wise to listen to people on the ground and get calibrated with what’s really going on.

It turns out that there are a lot of people like me who, while silent in the community, reap huge benefits. Yes – we’re out there, lurking around, listening to what’s being said, and selfishly tuning our own investment strategies and tactics in the background. I’ve done the math, and it seems there are about three times the number of people eavesdropping directly on the StockTwits web site than those actively creating value. However, the actual ratio is significantly larger. StockTwits streams are integrated into other web sites and viewed by some 40 million people, and a good portion of them are creating content.

Well that’s my StockTwits Sales Pitch for today. What I really want to write about is the StockTwits business model and advanced opportunities for sentiment analysis. I hope to find the time to do it.